are political contributions tax deductible for corporations

All four states have. The irs states you cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund.

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Generally speaking only contributions made to certain tax-exempt organizations.

. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes. A tax deduction allows a person to reduce their income as a result of certain expenses. For amounts over 750 33 will be charged.

The Taxpayer First Act Pub. Regardless of whether a political contribution is made in the form of. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to.

Political contributions deductible status is a myth. An example is the US. The Taxpayer First Act Pub.

Are political donations deductible 2020. You may deduct charitable contributions of money or property made to qualified organizations if you. The agency also bans businesses.

An expenditure is nondeductible under Treas. You can obtain these publications free of charge by calling 800-829-3676. The amount of the deduction for a contribution or gift of property is either the market value of the property on the day the contribution or gift was made or the amount.

These taxes should be documented and kept for future reference. Political donations to federal candidates and committees are not deductible from federal income taxes whether they are made online or in person. 116-25 Section 3101 requires electronic filing by exempt organizations in tax years.

These business contributions to the political organizations are not tax-deductible just like the individual. Required electronic filing by tax-exempt political organizations. 1162-29 to the extent it seeks to influence legislation.

You are to itemize your taxes on form 1040 Schedule A. This form itemizes your taxes to understand better what is or is not. There are five types of deductions for.

Political contributions arent tax deductible. Chamber of Commerce which is qualified under Internal Revenue Section 501 c 6. These taxes should be documented and kept for future reference.

To be precise the answer to this question is simply no. Membership dues paid to these groups are deductible by individuals or businesses. Examples include expenditures to.

Limits on Political Contributions. According to the IRS Most personal political contributions are not tax deductible. Are Political Contributions Tax Deductible For Corporations.

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible Smartasset

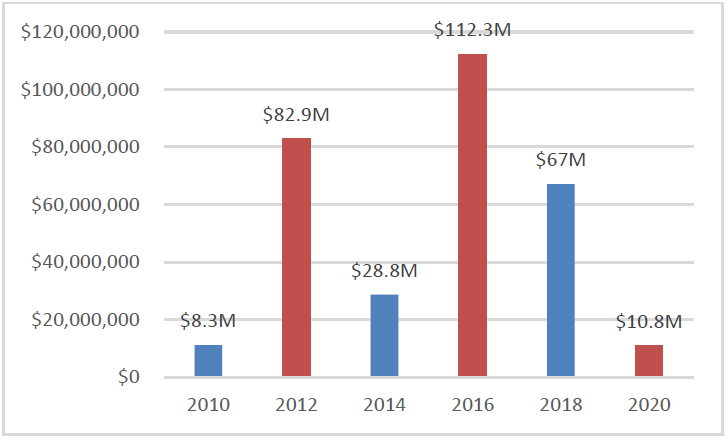

Billionaire Political Donations Pile Up In 2022 Who S Given The Most

Are Political Contributions Tax Deductible Personal Capital

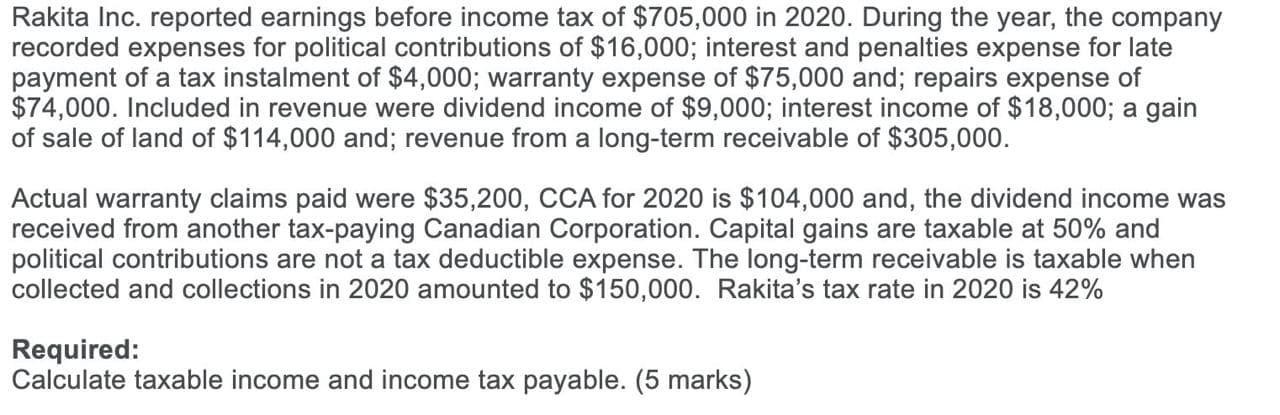

Solved Rakita Inc Reported Earnings Before Income Tax Of Chegg Com

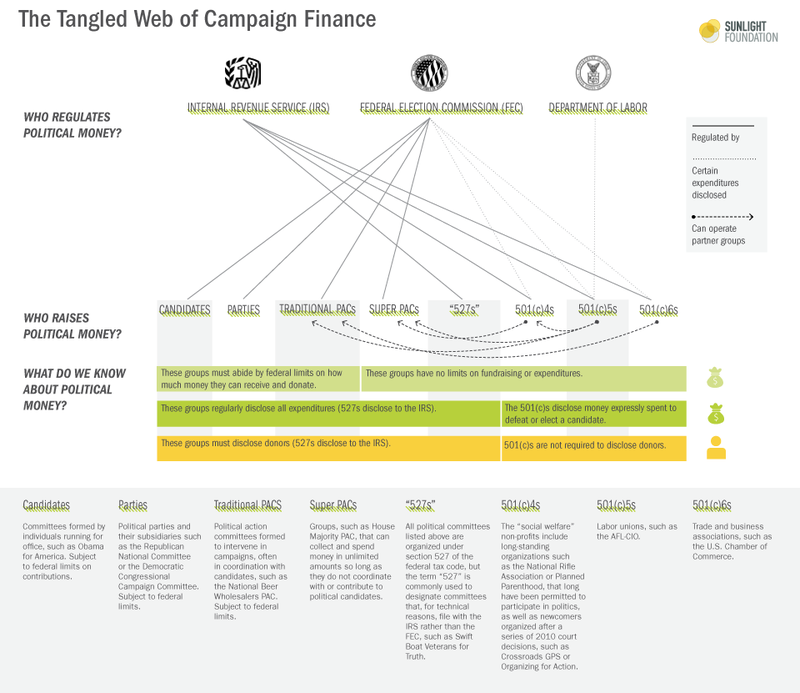

Campaign Finance In The United States Wikipedia

How Current Us Tax Policy Impacts Donors And Nonprofits

Who Pays U S Income Tax And How Much Pew Research Center

-Kelly-Smith-sPAqLWGKHWt6fR7kh.png)

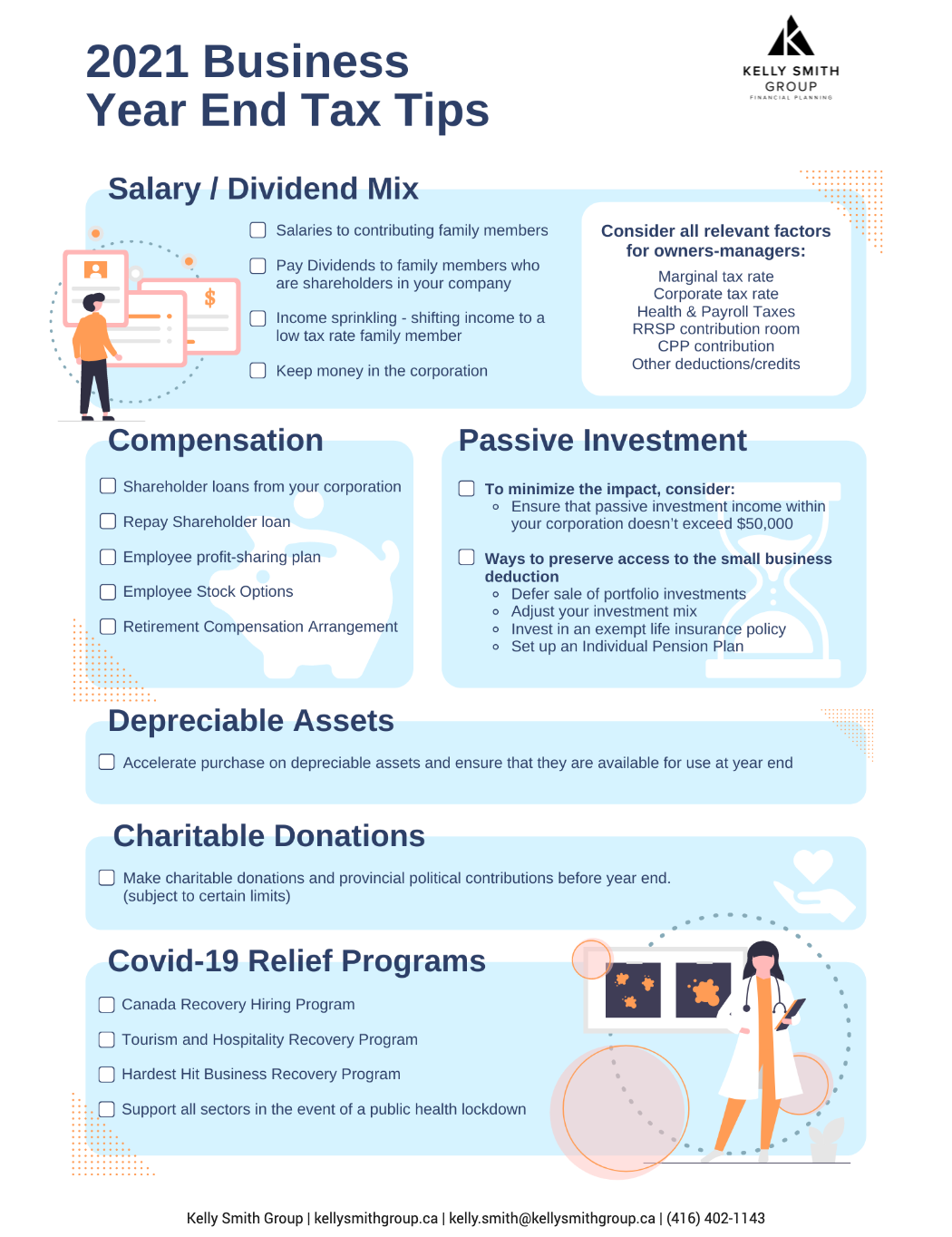

2021 Year End Tax Tips For Business Owners Kelly Smith Group

Are Political Donations Tax Deductible Paystubcreator

Should You Use A Credit Card To Make A Political Campaign Contribution Fox Business

Why Political Contributions Are Not Tax Deductible

Limits And Tax Treatment Of Political Contributions Spencer Law Firm

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible H R Block